Hourly to salary after taxes

Your average tax rate is. This means you pay 192200 in taxes on an annual salary of 18000 dollars.

Managing Payroll For Small Business Owners Bookkeeping Business Small Business Bookkeeping Small Business Organization

Thus 213000 annually will net you 155827.

. That means that your net pay will be 43041 per year or 3587 per month. At its peak this tax rate used to be 6 but a bill signed in 2016 by. Your average tax rate is.

This page calculates your taxes based on filing single. Your employer withholds a 62 Social Security tax and a. This means you pay 5717260 in taxes on an annual salary of.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Your average tax rate will be 1068 and your marginal rate will be 1765.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. We are working on the tax calculations for filing married jointly or as head of. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

It can also be used to help fill steps 3 and 4 of a W-4 form. Your average tax rate is. The Australian salary calculator for 202223 Hourly Tax Calculations.

Yearly salarytotal working hours in a year Total hourly salary. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. See where that hard-earned money goes - Federal Income Tax Social Security and.

Income taxes depend on your filing status. Usage of the Payroll Calculator. This was called the Hall Income Tax after Sen.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. If you know you work 40 hours a week for 50 weeks a year then you would multiply the hourly stated wage by. That means that your net pay will be 37957 per year or 3163 per month.

52000 2080 25 an hour. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Frank Hall the senator who sponsored it in 1929. You can personalise this tax. Enter your Hourly salary and click calculate.

Given you file as a single taxpayer you will only pay federal taxes. If you estimate that your Louisiana state tax liability after credits and other income taxes are withheld will exceed 1000 for single filers or 2000 for joint filers you must make whats. The calculator is updated with the tax.

If working part-time for example just 4 hours a day or half the daily work hours. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. That means that your net pay will be 40568 per year or 3381 per month.

See where that hard-earned money goes - with UK income tax National. The Hourly salary calculator for Australia. If you are paid 60000 a year then divide that by 12 to get 5000 per month.

You can use the calculator to compare your salaries between 2017 and 2022. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

How To Convert Hourly Wage To Annual Salary Quick Tips Salary Wage Simple Math

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Accoun Paycheck Salary Oregon

Yearly After Tax Income For 100k Yearly Salary In The United States The Federal Income Tax On A 100k Yearly Salar Salary Federal Income Tax Additional Income

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Calculator Templates

Self Employed Taxes How To Calculate Your Tax Payments Business Money Tax Money Advice

What Is Annual Income How To Calculate Your Salary

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Salary Slip Template Free Word Templates Survey Template Word Template Payroll Template

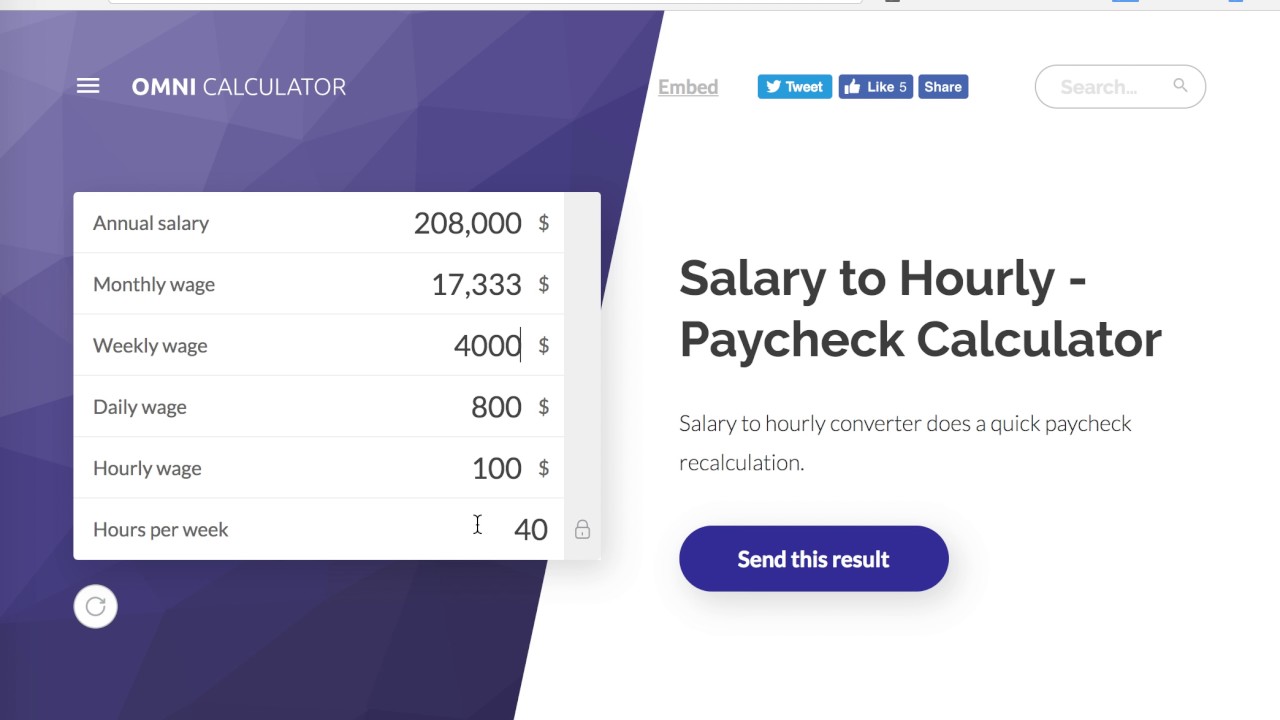

Salary To Hourly Salary Converter Omni Salary Paycheck Finance

Salary To Hourly Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Spreadsheet Template Life Planning Printables

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Money Net Income Credit Card Debt Relief Income

Calculating Hourly Pay For Secondary Special Education Life Skills Students Life Skills Special Education Special Education Life Skills Classroom

Salary Slip Templates 19 Free Printable Ms Docs Xlsx Templates Templates Printable Free Payroll Template

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary